It's the annual report season and among the many companies that we read about this one particularly caught our attention. The company we will discuss about is Intellect Design Arena (IDA). Before talking about this further I would like to draw attention to this particular extract from their investor presentation for FY17 available on their website

Here is a company which currently is loss making on an operational level and talks about

- Improving Operating margins from a loss to 26% in FY20

- Changing revenue mix from low margin implementation to high margin License & AMC

- Revenue growth guidance till FY20 of over 20%

Its a mandatory exercise to check past track record of a management which is giving such lofty projections for the future. When we looked at what Intellect has delivered in the past, this is what we found

In his interviews Arun Jain promises a growth in revenues of 20-25% over the coming years. Since listing IDA has delivered on the lower point of 20%.

However this has come at a cost

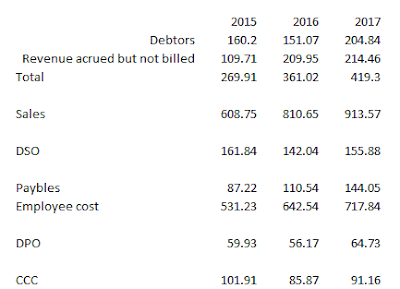

The company has an extended working capital cycle with receivable days around 6 months. Though the quantum has been coming down and management has mentioned in latest reports of focusing more on collections and hence the days of receivables outstanding over next few years would be a key operating metric to track

Business Model

IDA is a software company dealing in the products vertical which develops and implements product suites for the financial sector. To understand the business further here is some more information:

Intellect is present across four broad verticals i.e. iGCB(Global consumer banking), iGTB(Global transaction banking), iRTM(risk, treasury and markets) and iSEEC(Insurance). Within each domain, the company offers a variety of products that cater to specific needs of the consumer

Here is some information on how business evolution develops for a product company

A product company's life cycle can be broken into four parts - incubation (product building), catalyst (Customer reference building), adoption and monetization. Intellect currently has products across different stages in the cycle and as they move from reference building to adoption and ultimately monetization, the company will start enjoying the full benefits of operating leverage.

The management further goes on to say that every additional dollar of revenue earned will add 60 cents to the bottom line implying a net profit margin of over 60% on incremental business

All of this information is available in the company presentations put up on the website by the company

How does a company like IDA bill revenue

The revenue component for software companies is broken down into broad headings - the first being License & AMC Fee and the second being Implementation/Services fee. Besides this, there is a general practice of booking unbilled revenues The magnitude of which varies from company to company with global leaders like Temenos clocking in 80% of their revenues in the form of License & AMC Fee.

Note - Companies tend to partner with System Integrators for implementation of their software once they've achieved a certain scale. For instance, Temenos only partnered with third party's once it had started clocking $400mn in annual revenues - until then, all integration is done in house.)

Here is a chart from the company presentation depicting revenue mix and its change for IDA

After going through how the company earns let us understand what and ow much it needs to spend to earn its revenue

Being a young software product company, Intellect has to spend a considerable amount of its revenue on marketing its product to the mass market, the benefits of which accrue with time. In the past two years, the company has spent 32% of its revenues on sales & marketing. Here is a trend of how sales & marketing have moved in the past

We cross checked to see whether high expenditures are a norm in the sector. Because there is no similar competitor in India we looked at global peers, the leader being Temenos, a Swiss company

Another significant expense that software companies have to recognize on a recurring basis is high R&D - in terms of both product maintenance and new product development. The industry wide norm in case of development expenses is to capitalize them and subsequently amortize over a period of ten years. On the other hand, maintenance expenses are treated as an individual line item and deducted from revenues

Intellect spends close to 13% of revenues on R&D and has started capitalizing development expenses from FY'17 onwards. This has led to intangible assets on the balance sheet increasing from 32cr in FY'16 to 133cr in FY'17. Management guides for this trend to continue as R&D remains an integral part of running the business. The subsequent capitalization allowed IDA to post operating profits over the last two quarters. It remains to be understood that if this was the industry norm why wasn't IDA following the same from the start

There is not too much to understand from the past numbers of a loss making company and hence we tried to find out what is the opportunity pie for a company like IDA. To understand what's in store we read through what the leader was saying about the sector. Since there is no like to like competitor for IDA in the Indian markets we looked at the global leader Temenos.

Here is what Temenos had to say

In it's annual report of 2014, Temenos - a global software provider talked about the withering moat of the banking sector. Traditionally, banking has been a difficult business to penetrate across economies due to high levels of regulatory compliance and extensive infrastructure spend required to setup a bank from scratch. "Getting a license, setting up branch network and spending on setting up the core network entails a substantial amount of capital and time - two precious and scarce resources available to mankind". It is this precise reason as to why banks on an average clocked RoE's in the region of 15-17% between 1990 and 2008

What is changing...

The rapid strides made by technology in terms of un-bundling the entire banking experience into a single click of an app have opened up the floodgates for a host of agile fintech companies to garner incremental market share away from these once indomitable institutions The growing need of "banking as an experience" and the propensity of millennials to switch service providers has prompted banks to increasingly focus on upgrading their core legacy systems to match new competition and at the same time, cater to the fast evolving demand patterns of their customers

So What stops banks from adapting to new technologies?

A case study conducted by Ernst and Young concluded that core replacement for banks is a high risk affair characterized by lengthy delivery cycles and costs. Due to this, decisions to replace core platforms are being constantly deferred in the face of uncertainty and potential system disruption. Instead, what banks prefer is letting their legacy core systems run on the background and upgrading the front end to digital which helps them achieve the best of both worlds - enhanced customer service experience without having to transform the core platform

Here is what Arun Jain "promoter of IDA" has to say about the changing landscape of the IT industry

So to conclude we can see that

- IT industry is changing from a service play to a product play

- Opportunity size is huge as reiterated by the global leader

- Legacy platforms remain and hence opportunity lies in newer markets

Even though IDA is a business that got recently listed it has been in business for long when Polaris acquired the products division of Citibank and hence operating history for the company spans more than a decade

We looked at the past numbers of IDA and found some observations which warrants deeper attention:

Raising debt on books

Bringing out a rights issue to pay off a recurring revenue line item and general purposes

(in Rs million)

Another question that comes in mind after the recently concluded rights issue that Intellect has carried out is:

- Despite having cash to the tune of 116cr on books, why would the company feel the need to dilute equity especially when as much as 25% of the proceeds of the issue are to be expended for "general corporate purposes."

- What use would the 84cr lying in current accounts be of

From a net cash company on being de merged from Polaris to now a net debt position to having to raise a right issue. All in two years. The financial footing does not seem to be too strong for IDA. This makes us think as to was it a good idea to separate IDA from Polaris considering the desperate financial support IDA warrants every quarter.

The management mentions itself that there is a huge upside for the. Have a look at this extract from their interview

With the future being so bright as certified by the management we assumed management must be holding majority stake in the company. However the current shareholding looks like this

The promoter holds 31% in the company, which is pretty much off the maximum permissible 75% allowed. I was assuming management having majority stake considering

- Future looks very bright

- Promoter must be flush with cash considering sale of Polaris

However we can see that the promoters have been increasing stake over the last quarter so we tried to analyze what the promoter has done over the last two years since listing

As we can see in the above image the promoters have not added any stake to their overall shareholding over the last two years. During Sep 2016 two promoter entities got de classified which led to a reduction and over the last quarter the promoter has bought shares which shows us why there is an increase over last quarter. What i could conclude is that even though the promoters are very bullish on the business prospects, they have not backed that up with meaningful buying in the company shares

To conclude

- We need to keep a track on receivable days to measure if management is walking the talk on collections

- any increase in stake by promoter considering extremely bright prospects of company in near future

- improvement in operating metrics without any accounting adjustment

- fund flow due to the difficult financial situation IDA seems to be in

(Disclaimer : We have positions in the above mentioned stock and our views are likely to be biased as a result. This post should not be treated as a buy/sell recommendation. We are not SEBI Registered Investment Advisers nor Research Analysts.)

hey can give link to explore more about product company's life cycle.

ReplyDeletePretty deep and in depth. Good, Keep it up

ReplyDeleteThank You for the report

ReplyDeleteVery Good Insights on IDA. I got to know that IDA is on journey to become $132mn to $500mn in 5 years. Immediate upside could be 50-60% in 6 months time frame.

ReplyDeleteDisclosure: Have some exposure in IDA

Hi Dhruv, Could you show some light on IDA Q2 Results please.

ReplyDeleteHi Suresh, prima facie I'm encouraged by the further reduction in DSO days and the growth in the share of license + AMC fees to overall revenues. What we need to monitor is that whether this momentum can sustain over coming quarters

DeleteSimply outstanding

ReplyDeleteInteresting analysis. Thank you

ReplyDeleteWe are urgently in need of Kidney donors with the sum of $500,000.00,Email: customercareunitplc@gmail.com

ReplyDelete