This post got inspired by something I read on the internet last week. I follow a website on the internet https://25iq.com/

where the author has written a beautiful post on attributes of a scalable business. You can go and read the post from the following link A dozen attributes of a scalable business

One facet from that post caught my attention and i am presenting it here. Please read through the extract (emphasis mine)

The positive customer word of mouth that Rachleff describes is important for a business since it enables a lower customer acquisition cost (CAC). In other words, scalable businesses generating organic growth do not need massive spending on marketing and sales. Every business will have some customer acquisition costs but in the best and most scalable business that cost is relatively low. Bill Gurley agrees with Rachleff: “With great companies the consumers buy because the product is so good. They aren’t spending [tens of millions] on marketing.” Gurley also believes that customers quality if higher is they are organically acquired: “Organic users typically have a higher NPV, a higher conversion rate, a lower churn, and more satisfied than customers acquired through marketing spend.”

It is important to understand that growth is not always organic from the start of a business. Sometimes critical mass must be achieved in non-scalable ways before a business becomes scalable via organic customer acquisition. Paul Graham points out that sometimes doing what does not scale is essential to enabling critical mass which does allow a business to scale: “One of the most common types of advice we give at Y Combinator is to do things that don’t scale. In Airbnb’s case, these consisted of going door to door in New York, recruiting new users and helping existing ones improve their listings.”

After reading the above post the first thing that came into my mind was the innerwear industry in India and the leader in that sector "Page Industries", the franchisee for Jockey. Now in a consumer facing industry one of the biggest expenses is Customer Acquisition Cost termed as Selling & Distribution Expenses.

One would assume that the leader in the sector would be spending the highest amount on direct selling expenses, both as a percentage of sales and also absolute amounts. Also selling expenses are of three types:

From the above, one can clearly differentiate between companies having a good brand recall in public versus a company not enjoying a good brand recall. A company spending money on sales commission and incentives implies spending to push sales through distribution channel. A strong brand does not need to give incentives to the distribution channel because products enjoy a recall in the customer's mind.

The following exercise was performed to find how the leading companies stand in the inner wear and leisurewear industry

As we can see Rupa & Lux over the last five years have spent more on S&D than their competitor Page Industries which still sells 2 times more than either of these companies, is growing sales at a rate double than these two and has a much better brand recall evident by zero incentives given.where the author has written a beautiful post on attributes of a scalable business. You can go and read the post from the following link A dozen attributes of a scalable business

One facet from that post caught my attention and i am presenting it here. Please read through the extract (emphasis mine)

- Customer acquisition cost (CAC) is low in a scalable business since positive word of mouth is strong (i.e., the business benefits from organic customer acquisition)

The positive customer word of mouth that Rachleff describes is important for a business since it enables a lower customer acquisition cost (CAC). In other words, scalable businesses generating organic growth do not need massive spending on marketing and sales. Every business will have some customer acquisition costs but in the best and most scalable business that cost is relatively low. Bill Gurley agrees with Rachleff: “With great companies the consumers buy because the product is so good. They aren’t spending [tens of millions] on marketing.” Gurley also believes that customers quality if higher is they are organically acquired: “Organic users typically have a higher NPV, a higher conversion rate, a lower churn, and more satisfied than customers acquired through marketing spend.”

It is important to understand that growth is not always organic from the start of a business. Sometimes critical mass must be achieved in non-scalable ways before a business becomes scalable via organic customer acquisition. Paul Graham points out that sometimes doing what does not scale is essential to enabling critical mass which does allow a business to scale: “One of the most common types of advice we give at Y Combinator is to do things that don’t scale. In Airbnb’s case, these consisted of going door to door in New York, recruiting new users and helping existing ones improve their listings.”

After reading the above post the first thing that came into my mind was the innerwear industry in India and the leader in that sector "Page Industries", the franchisee for Jockey. Now in a consumer facing industry one of the biggest expenses is Customer Acquisition Cost termed as Selling & Distribution Expenses.

One would assume that the leader in the sector would be spending the highest amount on direct selling expenses, both as a percentage of sales and also absolute amounts. Also selling expenses are of three types:

- Advertisment Expenses (Directly help to build company's brand)

- Sales Commission & Incentives (Money spent on distributors to push sales)

- Other Selling Expenses (Indirect/Miscellaneous Selling Expenses)

From the above, one can clearly differentiate between companies having a good brand recall in public versus a company not enjoying a good brand recall. A company spending money on sales commission and incentives implies spending to push sales through distribution channel. A strong brand does not need to give incentives to the distribution channel because products enjoy a recall in the customer's mind.

The following exercise was performed to find how the leading companies stand in the inner wear and leisurewear industry

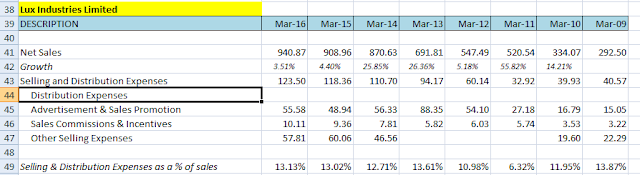

The figures for Lux Industries are for 2016

We can note following points from the above:

- Page Industries is the market leader with net sales of over rs 2100 crores as on FY17

- The two closest competitors viz Rupa & Page do less than half of the revenues of the market leader

- Page Industries spent 5.79% of its revenues on Selling & Distribution (S&D) while the same figure for Rupa & Lux Industries stood at 12.60% & 13.13% respectively.

- The S&D expenses for Page Industries have remained in the range of 5-6% of sales over the last six years while the same for RUPA & Lux has been over in the range of (10-13%) over the same time period

- The cumulative amount spent on S&D expenses by the companies over the last 5 years is as under:

- Page Industries: Rs 415 crores

- Rupa & Company: Rs 567 crores

- Lux Industries: Rs 507 crores

I also tried to see how much each of these companies ell purely on advertisment and the figures are as under

- Page Industries: Rs 318 crores

- Rupa & Company Ltd.: Rs 359 crores

- Lux Industries: Rs 303 crores

- Page Industries: Rs 0.85 crores

- Rupa & Company: Rs 78.62 crores

- Lux Industries: Rs 39 crores

Its enlightening to know that how good is the S&D strategy for Page Industries versus its competitors where it is able to target its brand effectively, spend lesser amount than its competitors and still keep making the brand stronger year after year. While the strategy that Rupa& Lux follow tells you why the innerwear & leisurewear market has been dominated so effectively by this one brand JOCKEY.

My purpose of this exercise was to show some facts on companies which do simple things everyday that go a long way in creating a sustainable franchisee. Many people would outline the PE of Page Industries or other valuation ratios showing how it is so very expensive versus the other relatively cheaper competitors. However, some time spent in knowing how a company is built, rather than always focusing on price tells you more than what the price of the company on the stock exchanges will show.

Remember the value of a company is the outcome of the work being done behind the scenes. If you focus only on the price you will miss out on a lot...