Banking is a treacherous yet lucrative business and there are institutions and people across global economies who have borne testimony to both sides of the coin. There are inherent similarities between what a bank does and what a trader does - both make money from money, earning the middleman's commission in the process.

Over the years banking has evolved from being a pure play provider of credit to a business offering multiple services under one umbrella. This widening of the ambit of services under offer has led to an increase in the role the management plays in the banking business. Thus we see a stark difference in valuations because of various ways in which banking is done. The difference in operations have led to distinctions like Public & Private Banks, Monolith and Multi operation banks and many others. Through this post we make an attempt to see how the banking sector has evolved in India

Over the years banking has evolved from being a pure play provider of credit to a business offering multiple services under one umbrella. This widening of the ambit of services under offer has led to an increase in the role the management plays in the banking business. Thus we see a stark difference in valuations because of various ways in which banking is done. The difference in operations have led to distinctions like Public & Private Banks, Monolith and Multi operation banks and many others. Through this post we make an attempt to see how the banking sector has evolved in India

The Indian banking fraternity has traditionally been the fortress of State owned enterprises who have held the lion's share of the market. Prior to 1991, PSU Banks accounted for 91% of the total assets in the system as they faced little by way of external competition. As the government and the RBI have opened up the sector over the years, incumbents have lost out on the incremental opportunity on a consistent basis thereby ceding ground to the more nimble and efficient private players.

In the ensuing chart, we have taken the Nifty PSU Bank and the Private Index as the sample sets and highlighted the cumulative advances growth over a ten year period

- Private Banks have comfortably outstripped their counterparts in terms of loan growth over a ten year period

- The difference however, is much more visible since the last five years as the bigwigs have barely climbed the ladder of growthProblems for SOB's gathered critical mass as the RBI initiated the Asset Quality Review(AQR) in FY'16 - thereby unearthing a casket of skeletons that Banks had been ever-greening for years. Slippages( which is defined as the amount of loans that turn bad during a given period) increased manifold as non-performing accounts that were being masqueraded as standard were re-classified, leading to a bucket full of slippages being thrown out into the open, especially for Public Banks

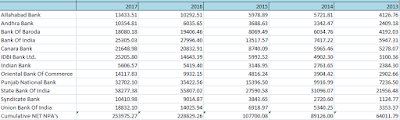

Cumulative annual gross slippages for PSU banks. Note the spike in slippages for 2016 These slippages have had a direct rub-off effect on the P&L's as incremental slippages leads to incremental provisioning that banks have to carry out against them. This in turn has depleted profitability for state owned banks.Growth Banking needs growth capital and one of the primary sources of growth capital for a bank is the re-investment of its profits into business so as to augment balance sheet leverage.We collected provisioning figures for the past five years for the Nifty PSU Bank Index to further explore the decay in the Profit and Loss StatementIn the absence of book profits, PSU Banks have had to constantly tap external sources of capital to keep the balance sheet afloat

The cumulative capital raised by the constituents of the Nifty PSU Bank Index has been to the tune of approximately 42300 crores. This has primarily served as a buffer against the incremental provisioning that has plagued profits, leaving little room to grow the business.

(We assume that a big chunk of this capital for these banks have come in by way of the Indradhanush program of the central government)

The recapitalizationThe government's decision to infuse a mammoth two lakh crores into its banks to recapitalize balance sheets has been well received by the corporate and the investment fraternity alike.For starters, let us first explore the cumulative networth of the Nifty PSU bank Index

Addition of approximately two lakh crores would mean that the total equity would now go upto nearly six and a half lakh crores. With enhanced Tier 1 ratios, bank managements would have the luxury of throwing in the kitchen sink of provisions and expanding balance sheet leverage to revive capital formation in the economy.Let us first explain the part on provisioning..Net NPA's of PSU Banks

Net NPA's are simply the residual bad loans left after the provisioning done in the profit and loss statement. The RBI puts forward two broad categories/steps for providing for bad loans - substandard and doubtful. Within doubtful assets, there are three sub-categories based on time periods - upto one year, one to three years and more than three years. The quantum of provisioning at each stage is well explained by SBIN in their annual reportOut of the cumulative NPA's of 2.3 lakh crore, one would assume that cases referred to the NCLT would form a major portion of the pie. (For instance, stressed Steel accounts contribute to thirty one percent of total NPA's for SBIN!)

Resolution of these large cases would then dictate the quantum of write-offs that banks would have to further take on them. Subsequent to the provisioning, banks would then have the remainder of the recap money available for re-investment in the form of growth capital.

As a summary, an investor can look at two key factors for PSU Banks in the coming months

- The resolution of cases referred to the NCLT - the quantum of recoveries would dictate whether banks make or write back provisions

- Post resolution, the amount of growth capital that each bank would have at its disposal

Wealth Creation in banking has been a direct function of two key features - a vibrant corporate culture and strong credit under-writing. It is the combination of these two factors that has led to creation of brands like HDFC in a business which sells plain vanilla commodity products. Public sector banks have for long been at the receiving end of following substandard appraisal processes, leading to significant erosion of equity over the years. The bank recap plan should go a long way in healing near term stress - but, will the nightmare of the past decade make these organizations leaner for the future? Only time will tell.

We will continue this post with a primer on understanding basics of the banking sector and what one needs to understand while looking at the financials of a banking company

Thanks for sharing this deep information keep it up.

ReplyDeleteI really thankful to you because this information is really great and knowledgeable for all peoples...I refer to this blog with my friends.

Thanks

what is TDS

Thanks for sharing. Your blog is really helpful for us.

ReplyDeleteSEBI Registered Company list

SEBI Registered Investment advisor`

Housing Finanace

ReplyDeleteProject Loan in Ahmedabad

ReplyDeleteThank you so much for sharing a great article. Keep up the great work!

ReplyDeletedata entry business opportunities