Sometimes

there exists a situation which becomes difficult for the human mind to

comprehend. The sugar sector in India is one such where it is difficult

to understand why such a dire situation exists for a sector which forms a

backbone for the agrarian economy in the country.

This has been proven time and again that for anything to flourish the entire ecosystem has to benefit.

We cannot expect to compensate one part of the value chain by squeezing

the neck of the other. However this is what existed in the sugar sector

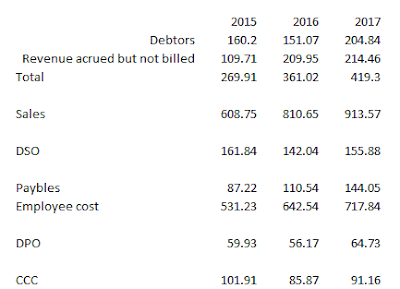

as early as 2015. Have a look at what the biggest sugar miller in India

had to say in 2015….

This

is an extract from the annual report of Balrampur Chini in 2015. We

cannot expect to hold one part of the value chain at ransom to over

compensate the requirements of another. This is simply not sustainable,

especially in a sector which is so important to the ecosystem of the

country. Let’s have a look at some simple facts of the sugar economy in

India

Facts about the Indian Sugar Industry

- Aggregate demand of 25MT with a population of 1.32 billion as on 2016

- Per capita consumption of around 20kg per year

- India is the world’s largest consumer and second largest producer in the world

However in 2017 the company had a different tone

The profits have shot up

This

is an exercise in finding out what changed and foremost what ails this

sector so deeply that it forms a part of the untouchables for many. To

understand that we tried to dig deep into the workings of the sugar

sector and this is Part 1 of our exercise which will be followed by much

deeper understandings of how this industry works and is anything

changing?

Let’s first understand how sugar is made…

The

process of making sugar starts at the farmland with the sowing of the

sugarcane crop. Sugarcane is a water-intensive crop (1 kg of sugar

production in Maharashtra requires around 2300 liters of water) and any

shortage of the same significantly inhibits growth.

In India, there are three variants of the same namely –

- The spring crop sown in March,

- The Adsali Crop sown in July and

- The Autumn Crop sown in September

The adsali and the spring

Crop take 18 months to mature while the autumn crop takes 12 months to

mature before they can be cut and sent to sugar mills for further

processing.

The

cultivation of sugarcane happens through the age old ‘ratooning’ method

in which subterranean buds on stubble (the part of cane left

underground after harvesting plant cane), gives rise to succeeding crop

stand which is usually referred to as ‘ratoon’ or the ‘stubble crop’

Now that we know how sugarcane is cultivated & harvested let’s understand what happens next…

Once the cane is harvested, it is then taken to the sugar factory for conversion. The sugar mill needs to be in very close proximity to the sugarcane farms.

Let’s understand why…..

- A longer distance between farm and mill would increase the cost of production

- The sucrose content in cane rapidly declines after harvesting hence time between harvesting and conversion needs to be minimized

The conversion process

Let us first present a flow chart that depicts how sugarcane is converted among the many products

(Source: Dwarikesh Sugar)

- A sugar mill can be a standalone facility where the output is only sugar or an integrated facility producing other by products as well

- By products of crushing sugarcane are sugar, molasses & bagasse

- While molasses are used to produce ethanol & alcohol, bagasse is used to generate power

Let’s understand how an integrated facility helps…

- Bagasse used to generate power is used for own production as well as sold in open market

- Ethanol is mandated to be used as an additive in fuel

- Molasses are sold to the alcohol industry

All of this helps in managing realizations as sugar production is weighed down by high fixed costs, volatile realizations & vagaries of government policies. Let us try an understand each of these point in details

High Fixed Costs

For

any commoditized business, having low cost production and optimizing

usage of by-products are imperative for sustaining profitability. In

this case, optimizing output from each ton of cane

procured is an absolute necessity for an integrated mill to ensure

maximum production of both sugar and its associated by-products.

This variable is measured by tracking the recovery rate. The

recovery rate is the quantity of sugar that is retrieved from

processing one tone of sugarcane. Let us explain how this works. For eg:

If the recovery rate is 11.5% that means for every tone of cane

processed you get 115 kilograms of sugarcane.

The recovery rate is not standard across regions. It depends on soil, climatic conditions, variety of crop used, etc.

Let us now show you how the recovery rate affects all the byproducts of sugarcane conversion assuming 1 tonne of sugarcane

Vagaries of Government Policies

To understand how the government policies affect the sugar sector first let us understand why the sugar sector is so important for the government:

- With 5 million hectares of land under cultivation the industry supports over 50 million farmers

- The three big states of Uttar Pradesh, Maharashtra & Karnataka produce over 75% of the production

- While Uttar Pradesh is dominated by private companies, Maharashtra is dominated by co operative mills belonging to state government

- The production capacity in the country is roughly distributed equally among private and co operative entities

Thus the Central Government sets

the Fair Remunerative Price (FRP) each year, which is the minimum price

the sugar mill has to pay the farmer while procuring cane. On top of

this sugar producing states set their very own State Advised Price (SAP)

which many a times is much higher than FRP for reasons best known by

the State Governments themselves

Let us have a look at how the mood of the government decides the pricing of sugarcane in the market…

The blue line shows how SAP has moved over the years while the pink line shows the gap between SAP and FRP in Uttar Pradesh

Have

a look at how the SAP more than doubled in 5 years during 2009-14. This

was the period when Mayawati governed Uttar Pradesh as the Chief

Minister while there was a Congress led government at the Centre

While the SAP decides the cost of procurement for the mills the final selling price depends upon various factors viz. export quota, domestic demand, government controlled levy.

Let us understand each of these in detail…

Domestic demand

This

is the demand supply situation in the domestic market. The supply

depends not just on the production but also the opening stock for that

year. The demand for sugar being a basic necessity remains constant and

keeps inching up every year. Since demand is relatively inelastic

pricing should remain more or less stable. However, the supply is very

volatile, which means it is not the demand which is the problem but what

moves supply.

Let’s have a look at how ex mill sugar prices have moved over the last decade

As

we can see the current ex mill prices are the highest in over a decade.

As we write ex mill prices for sugar trade in the same range as of

FY17.

Government controlled levy

This

regulation that the government used to impose on sugar companies was

called the monthly release mechanism by which the Government controlled

the quantity that Mills could 'release' into the open market. In

addition to the release mechanism, sugar mills had to sell 10% of their

produce to the Central government under the levy quota at subsidized

rates.

Exports/Imports

The government controls import and export of sugar in the country

The

prices of sugar have kept falling in the international markets over the

last year. However, the government incased import duty to the already

existing 40% by another 10% to stop cheap global sugar from flooding the

Indian markets. Similarly when prices increase in global market sugar

companies can only export on a pre fixed quota mechanism thus not

allowing domestic pricing to be affected by global volatility

Let’s see how all of this interference affects the sugar economics in the country

We use Dwarikesh Sugar as a case study to understand how companies operating in sugar sector were affected

Notice the difference between SAP and the cost of raw materials booked by the company

Notice the way realizations moved in relation to cost

This led to gross margins falling from a high of 58% to negative 4%

Here is a case explaining how FRP & SAP affect pricing for sugar companies in Uttar Pradesh

The

FRP set by the central government entails a base price with benchmark

recoveries of 9.5%. For every additional recovery that mills make out of

their cane, they have to pay the farmer an incentive of Rs 2.68/quintal

for every 0.1% of additional recovery.

We use another case study of Ponni Sugars to show the attitude of the government while the companies were bleeding

Now let us see what the biggest sugar producer in India had to say two years ago…

This

is what the MD of Balrampur Chini Mills had to say in the Annual Report

of 2015. The industry was dying. He suggested a solution. Most of the

steps advocated were similar to what the Rangarajan Committee had recommended noted as under:

- De regulation of Indian sugar sector

- Linking cane procurement price with market pricing of sugar

- Abolishment of monthly release mechanism and levy sugar quota

- Revenue sharing with farmers from processing of other by products of sugarcane

- Stable external trade policy with moderate tariff levels

So what has the Government done…?

- The state governments of Karnataka and Maharashtra have approved the implementation of the Rangarajan committee recommendations

- The central ministry has written to the Uttar Pradesh government to implement Rangarajan committee recommendations (central and state governments in Uttar Pradesh are similar)

The situation today

India

is expected to produce around 25.5mt of sugar this year, primarily led

by significantly higher output from Maharashtra and Karnataka. With

domestic demand being stable around that 25mt mark, there shouldn't be a

need for imports into the market. With demand and supply being in

equilibrium and the central government pushing the implementation of the

cane pricing formula of the Rangarajan committee in U.P, prices could

be stable moving ahead. Stability in prices will lend themselves to a

stream of free cash for companies as growth capex isn’t on the anvil

yet.

De-leveraging

balance sheets and subsequent conversion of debt into equity has been

one of the prominent highlights of corporate India in recent times and

the sugar sector is no exception to that. In the past couple of years,

most sugar companies have diverted all of their cash flows towards debt

repayment and have healthier balance sheets

The

following is an extract from Ind-Ratings highlighting the opening stock

for FY2018 which should keep the prices stable as the opening stock is

lower than the typical buffer kept by companies

Important understandings

- Financial condition of sugar mills on a much better footing than 2-3 years ago

- Most of the cash flows generated over last two years have been utilized in debt repayments

- No growth capex done. However, once situation improves many mills now closed can soon start operations

- Government has implemented structural changes in the sector and states are now more pro active towards plight of mills

This

is a part of the series in which we have tried to understand sugar

sector. In the next part we will have a look at individual companies

across different regions to understand how companies have evolved over

the last two decades in different regions